This article is for accountants who are running their firms and want to master Xero for accountants. The core question we are addressing is: How and where should an accountant use Xero to gain the most value, and what approach will help unlock its full potential? Rather than simply listing features, this guide helps you navigate how Xero can support your goals as an accountant and firm owner.

Table Of Contents

Core Features That Power Your Xero Workflow

Xero offers powerful core tools that form the foundation of efficient accounting processes. Here’s what accountants should focus on:

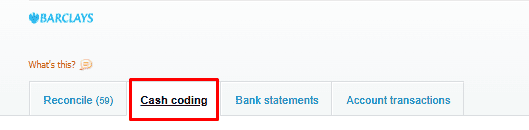

Cash Coding

Cash Coding in Xero is a fast and efficient way to bulk reconcile your bank transactions—especially useful when you have lots of small, repetitive entries (like expenses or receipts).

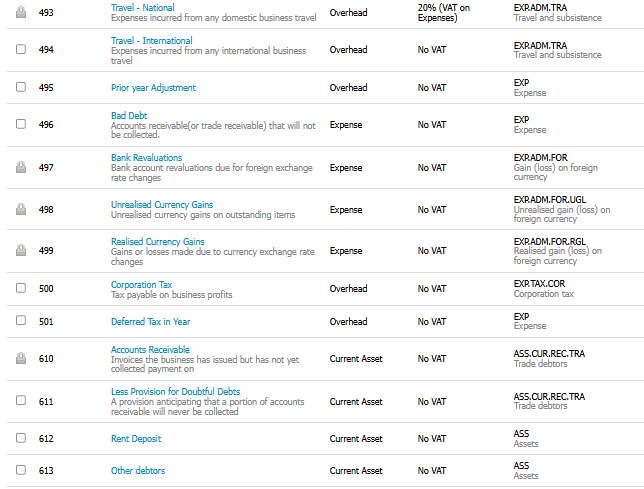

Accounting Codes Ordered by Nature of Accounts

A structured chart of accounts, aligned by asset, liability, income, and expense categories, ensures consistent coding and reporting accuracy. 200 series- Incomes, 300 series- Direct Expense, 400 series- Overheads, 500- Corportion Tax, 600 series- Current Assets, 700 series- Fixed Assets, 800 series- Current Liablilities, 900 series- Long Term Liablilites & Equity

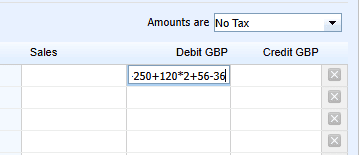

Built-in Calculator

Xero allows inline calculations within entry fields. Need to split an invoice or adjust figures on the go? Just type your math directly.

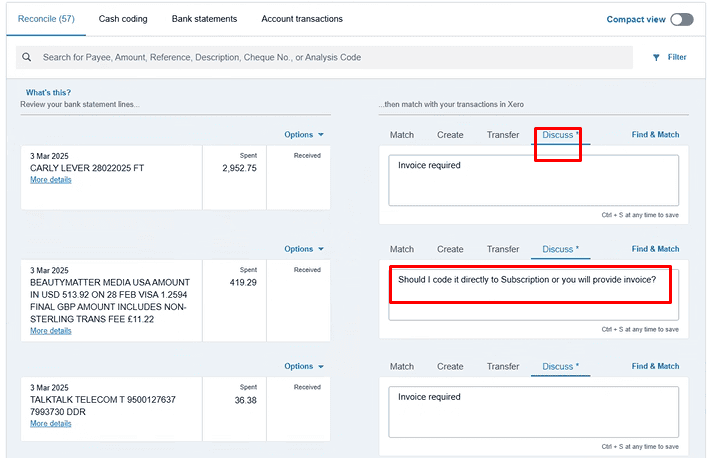

Discuss Box for Queries

Collaborate inside the platform. Leave notes or questions directly on entries — ideal for accountants working with remote clients or internal teams.

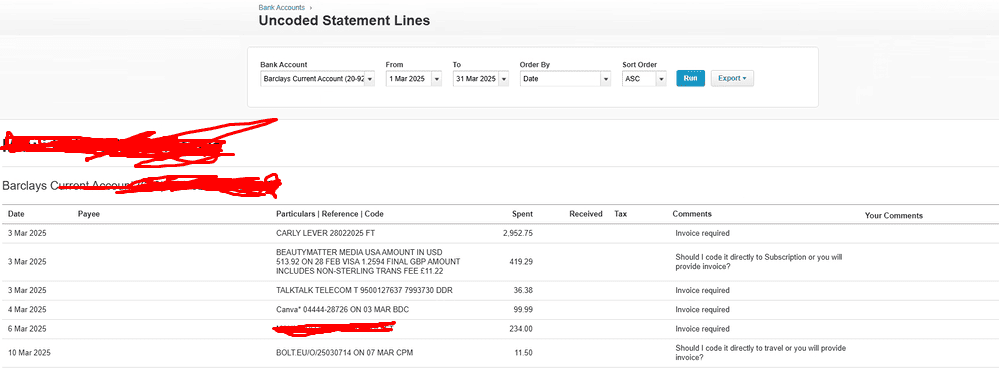

Uncoded Statement Lines ready to share with client

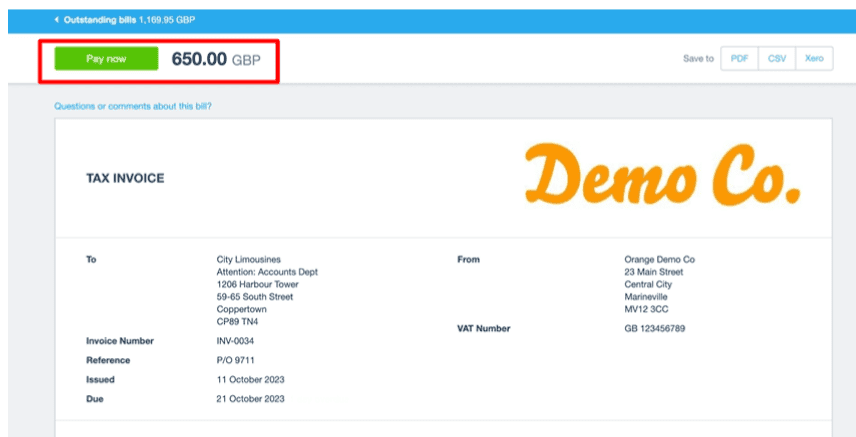

Pay Now Button on Invoices

Enable clients to receive faster payments by activating the Pay Now button with integrations like Stripe or GoCardless.

Bank Feed

Live bank feeds automate data import, reducing manual entry and ensuring up-to-date bank reconciliation.

Document Feed (Hubdoc, Dext, etc.)

Automated data capture tools like Hubdoc and Dext pull in bills and receipts, attach source documents, and post them to Xero — audit trail included.

Bank Rules

Create custom rules to auto-categorize recurring bank transactions. This saves time and keeps coding consistent.

Recurring Journals

For monthly accruals or payroll, use recurring journals to automate repetitive adjustments.

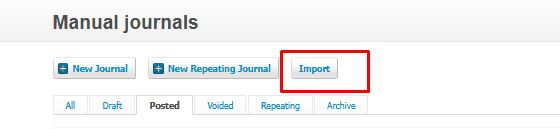

Importing Journals

This extremely helpful in cases where you have Excel calculations leading to the journal. You can embed the Xero journal template in the calculations. The Excel JV sheet can be moved & imported to Xero. It saves a lot of time entering a mannual journal in Xero.

Importing Data – Move My Books

Switching from Sage or QuickBooks? Xero’s Move My Books service helps accountants migrate client data with minimal friction.

Depreciation / Fixed Asset Register

Manage fixed assets, calculate depreciation, and post automated journal entries — all within Xero.

Late Claims

Client expenses or corrections made after a VAT quarter ends (e.g., December) are automatically carried into the next VAT quarter in Xero. These adjustments are clearly identified, ensuring compliance and making reconciliation faster and easier.

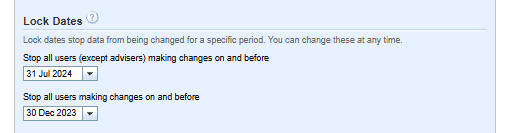

Lock Dates

Protect your closed periods by setting lock dates — a must for accountants preparing year-end reports.

Xero Useful Features

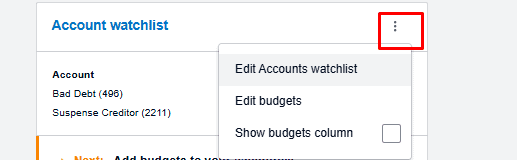

Watched Accounts on Dashboard

Track key accounts like VAT, payroll liabilities, or director’s loan on your dashboard — helpful for monitoring red flags in real time.

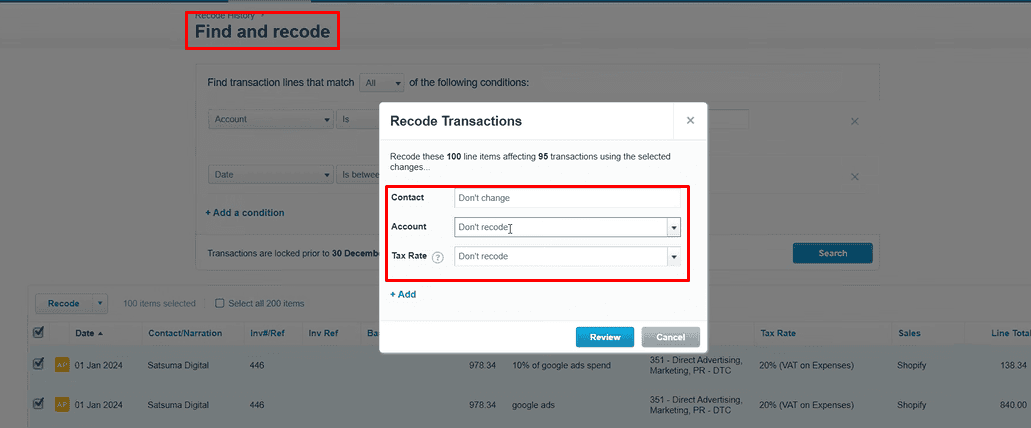

Find & Recode

Mass-edit past transactions with the Find & Recode tool — invaluable for fixing incorrect account codes, tracking categories, or VAT rates.

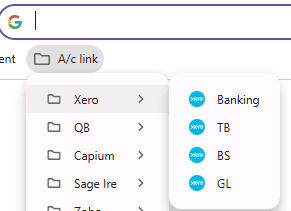

Bookmarks Bar

Speed up navigation by bookmarking key reports like P&L, Balance Sheet, Payroll or Bank Reconciliation — a small hack that saves big time.

Search Window on Every Screen

The global search bar makes jumping to contacts, invoices, or settings instant. For accountants working with multiple clients, this is a time-saver.

Supplier Email Sync in Activity Tab

Emails sent to suppliers via Xero are visible in their activity tab — ideal for tracing communications and resolving queries.

Multi-Currency Feature

For international clients, Xero’s multi-currency handling enables invoices, bank accounts, and reporting in multiple currencies (Premium Plan only).

VAT on Debtors

Track VAT adjustments on outstanding receivables — especially useful for cash accounting VAT schemes.

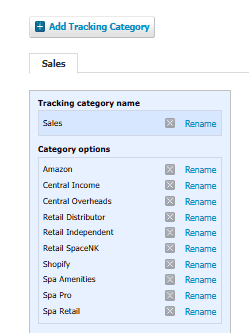

Categories

Use tracking categories to segment business performance by location, department, or revenue stream — offering deeper insights for advisory services.

Debtor Filters

Quickly filter unpaid invoices by due date, client, or amount — helping identify aged receivables and cash flow risks.

Journal Report

Get a clean report of all manual journals posted. Useful for audits and client reviews.

VAT Full-Year Report

Instead of reviewing VAT quarter-by-quarter, use the full-year view for annual returns or when conducting reviews.

Common Mistakes While Working with Xero

VAT on Purchases with No Actual VAT

Be mindful when applying VAT codes. Selecting “Standard Rated” when the supplier isn’t VAT-registered can lead to incorrect reclaim.

Incorrect Account Coding

For example, stationery purchases should be coded under 401 Office Stationery, not 701 Office Equipment. Following a structured chart prevents misclassification.

Salary Payment Misposted

Wages paid should hit 800 – Liability accounts, not 400 – Expense, especially when using payroll journals.

VAT Treatment on Taxi Reimbursements

If rebilled to the client, VAT must be charged. Many mistakenly treat these as VAT-free, which isn’t correct if you’re VAT registered.

Unreconcile vs Remove & Redo

“Unreconcile” doesn’t reverse the transaction — it only breaks the bank link. Use “Remove & Redo” to properly undo and correct errors.

Zero Rated vs No VAT

Zero Rated: Items are VAT applicable but at 0%. Shows on the VAT return.

No VAT: Used for VAT-exempt expenses like payroll, insurance, or interest. These won’t appear on the return.

Challenges in Xero

Importing Transactions from Other Software

While Xero allows imports via CSV or migration tools, formatting can be tricky. Mapping errors or duplicate entries are common.

Can’t View Journals Behind Each Transaction

For newer users, it’s frustrating not seeing the double-entry behind every action. You may need to rely on reports or advisors for clarity.

Bank Reconciliation Issues

Clients often incorrectly match or skip transactions. Without training, reconciliation can result in unmatched entries or timing errors.

Payroll feature basic

Xero offers very basic payroll. So, many businesses use other payroll software like BrightPay, Payroll Manager, or Employment Hero to handle payroll. These payroll tools can connect with Xero through APIs, so they can automatically send payroll journal entries into Xero.

Popular Xero Integration

Xero’s open ecosystem allows seamless connections to tools that enhance the accounting workflow.

Hubdoc , Dext, Apron

OCR tools for automated bill capture, document storage, and audit-ready posting directly into Xero.

Fathom

Financial reporting and analysis tool that transforms Xero data into visual management reports — loved by advisory-focused accountants.

Move My Books

Assists in migrating data from Sage, QuickBooks, and other systems to Xero — useful for accountants onboarding new clients.

Link My Books

Ecommerce-focused tool that integrates Amazon, Shopify, eBay and more, simplifying transaction posting and VAT tracking.

Telleroo

Bulk payments made easy. Push approved pay runs from Xero into Telleroo and pay vendors or employees in one go.

Unleashed

Advanced inventory management solution that integrates with Xero — great for clients who sell physical products.

Float

Real-time cash flow forecasting tool that connects directly to Xero. Helps clients plan for the future with greater confidence.

Final Thoughts

Using Xero for accountant workflows doesn’t just improve efficiency — it enhances collaboration, compliance, and advisory potential. With the right features enabled and integrations in place, accountants can focus more on delivering value and less on repetitive tasks.

See how we’ve helped businesses like yours.

Discover real success stories where we’ve streamlined accounting processes, enhanced efficiency, and reduced costs for UK firms.